How to use:

1. Click Remix

2. Create your account

3. Add required API keys to the Vault

4. Try the agent in debug mode

Stop Drowning in Invoice Paperwork – Automate Your Invoice Processing in Minutes With AI

The Hidden Costs of Manual Invoice Processing

Did you know that processing a single invoice manually costs your business between $12 and $30? That’s money silently disappearing from your bottom line with every bill that crosses your desk. But the true expense goes far beyond just dollars and cents.

When your team handles invoices by hand, they’re spending 8-14 days pushing paper instead of driving your business forward. Think about it: opening envelopes, typing numbers into spreadsheets, chasing approvals, and fixing mistakes. That’s valuable time that could be spent on growing your business.

Manual data entry creates a perfect storm for errors. A simple mistyped digit can lead to overpayments, underpayments, or duplicate payments that drain your bank account. In fact, many businesses don’t even realize they’re paying the same bill twice until it’s too late. These mistakes aren’t just costly—they can damage your relationships with vendors when payments are delayed or incorrect.

The ripple effects touch every corner of your business. Misclassified expenses throw off your financial reporting. Late payments lead to penalty fees and missed early payment discounts. And the stress? Your accounting team feels it every month-end close when they’re drowning in paperwork instead of providing the financial insights you need.

The most expensive part of manual invoice processing isn’t what you can see—it’s the hidden opportunities lost while your team is stuck in paperwork quicksand instead of focusing on strategic work that drives real value.

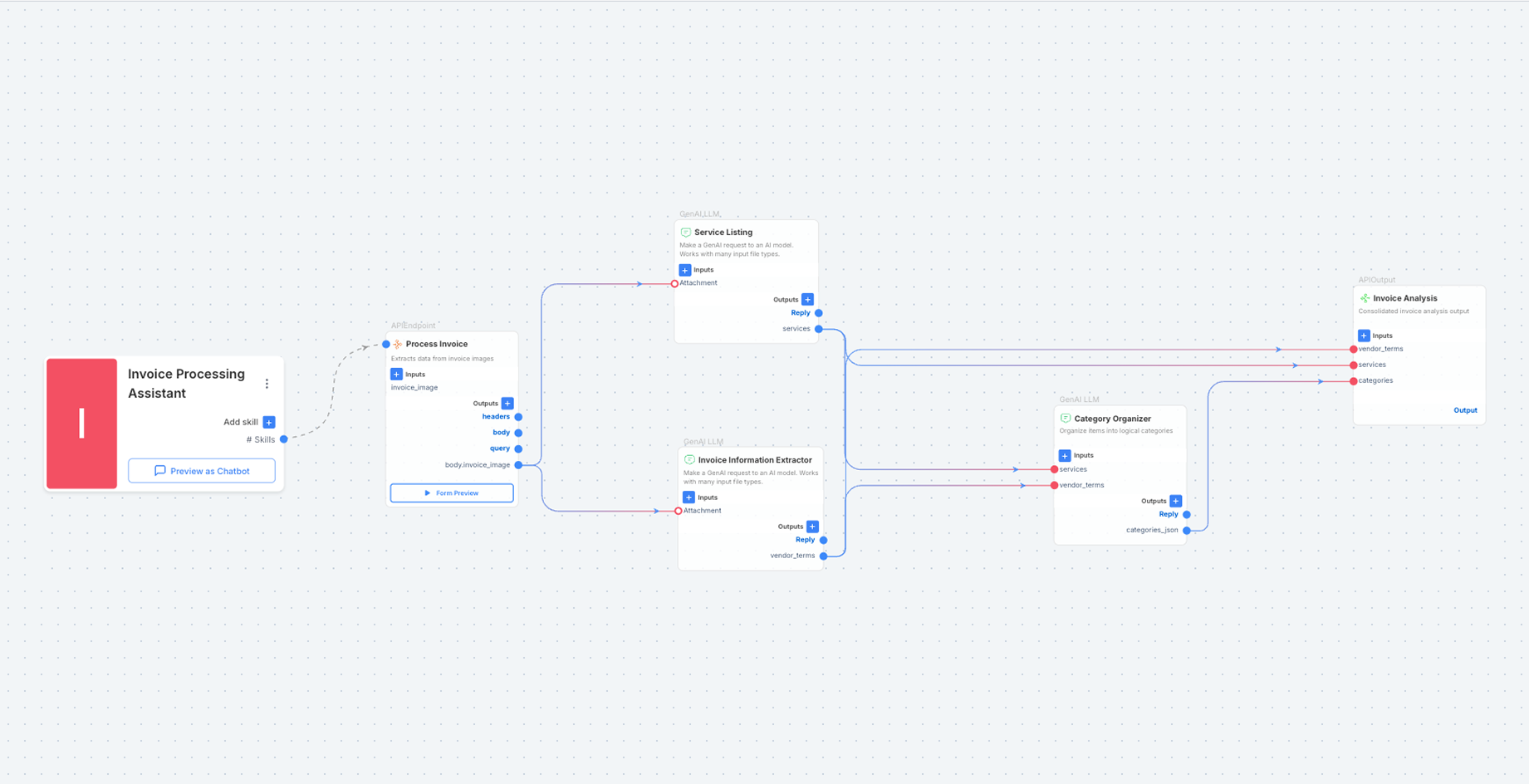

How the Invoice Processing Assistant Works

Ever wondered how our Invoice Processing Assistant turns your pile of paperwork into organized data? It’s like having a super-smart helper who never gets tired or makes mistakes! Let’s break down this magic into four simple steps.

First comes intelligent document capture. Our invoice scanning service works with all types of invoices – whether they’re PDFs in your email, photos taken with your phone, or scanned documents. Just upload them, and the assistant gets to work right away, no matter how the invoice looks.

Next is comprehensive data extraction. This is where our invoice data capture tools shine! The assistant reads everything important – vendor names, dates, invoice numbers, payment terms, and every single item you’ve been charged for. It even understands different invoice layouts without getting confused.

The third step is smart categorization. Our invoice categorization tool automatically sorts all those line items into the right expense categories. No more guessing which department should pay for what or manually tagging expenses for tax purposes – it’s all done instantly and accurately.

Finally, there’s workflow integration. This is the real time-saver! With invoice workflow automation, the processed information flows directly into your accounting software, approval systems, or payment platforms. The right people get notified automatically when their approval is needed, and everything stays organized in one place.

The best part? You don’t need to be a tech expert to use any of this. SmythOS has designed the Invoice Processing Assistant to be incredibly user-friendly while working behind the scenes with powerful AI technology. It learns from each invoice it processes, getting smarter and more accurate over time.

Meet Your Digital Invoice Processing Assistant

Say hello to your new accounts payable superhero! The SmythOS Invoice Processing Assistant works around the clock to transform your mountain of paperwork into organized, accurate data – without breaking a sweat.

This intelligent invoice OCR solution does in seconds what might take your team hours. Simply upload your invoice images, and watch as it automatically identifies and extracts all the important information: vendor details, due dates, payment terms, and every single item on your bill.

Unlike humans who get tired or distracted, your digital assistant never makes typing mistakes or forgets to enter information. The automated invoice extraction technology reads even the tiniest details on your invoices with amazing accuracy.

The best part? You don’t need to be a tech wizard to use it. SmythOS has designed this assistant to be incredibly user-friendly. There’s no coding required, no complex setup, and no lengthy training period. It’s ready to start working for you right away.

With the SmythOS Invoice Processing Assistant by your side, you can finally stop wasting valuable time on data entry and focus on what really matters – growing your business and making smart financial decisions based on properly organized information.

The Old Way vs. The SmythOS Way

Remember the days of drowning in paper invoices? The old way of handling invoices is like trying to build a sandcastle while the tide is coming in – exhausting and ultimately futile.

With traditional methods, your team spends hours manually typing invoice details into systems, squinting at fuzzy numbers, and making costly typing mistakes. Invoices pile up on desks, get lost in email inboxes, or worse – disappear completely! Vendors call constantly asking about payment status, and your approval process moves at a snail’s pace.

The SmythOS way changes everything. Our automated invoice processing system works like a tireless assistant who never needs coffee breaks. It uses smart OCR invoice reader technology to instantly capture all important information from your invoices – vendor names, amounts, due dates, and even the tiniest details in line items.

Here’s what changes when you switch:

Processing time? Cut by 80%. What took days now takes minutes.

Data accuracy? Near perfect. No more typos or misread numbers wreaking havoc on your books.

Vendor invoice management becomes a breeze when every document is automatically organized, categorized, and searchable.

Your finance team transforms from data-entry clerks into strategic partners who can focus on analysis and improvements instead of paperwork.

The best part? You don’t need to be a tech genius to make this happen. SmythOS has made powerful AI accessible to everyone, so you can set up your invoice automation system in minutes, not months.

Why keep wading through paperwork when you could be riding the wave of efficiency with SmythOS?

Real-World Impact: From Overwhelmed to Optimized

Westfield Accounting Services was drowning in paper. Every month, their team of 12 accountants spent countless hours manually typing invoice details into their system. Mistakes were common, clients were getting frustrated, and the backlog kept growing.

“We were working overtime just to keep up,” says Maria Chen, Head of Operations at Westfield. “Our team was stressed, and we were losing clients to firms that could process work faster.”

Then everything changed. After implementing the SmythOS Invoice Processing Assistant, Westfield’s paperless invoice processing revolution began almost overnight.

The results speak for themselves:

• Processing speed increased by an amazing 320%

• Invoice information extraction errors dropped by 98%

• 85 staff hours were freed up every month

• Client satisfaction scores jumped from 3.2 to 4.8 out of 5

“What used to take us 8 minutes per invoice now takes less than 2,” explains Maria. “The AI catches details our tired eyes missed. Now my team focuses on giving financial advice instead of typing numbers all day.”

The competitive advantage has been clear. Westfield has added 15 new clients in just three months, all referred by existing customers impressed with their lightning-fast turnaround times.

“Our staff is happier too,” adds Maria. “Nobody went into accounting because they love typing numbers from paper invoices. Now they’re doing the meaningful work they were trained for.”

Westfield’s success story isn’t unique. Businesses across industries are discovering how AI-powered invoice processing transforms not just their paperwork, but their entire operation.

Quick Start Guide: Automate Your Invoice Processing Today

Ready to say goodbye to manual invoice processing headaches? Getting started with SmythOS’s invoice automation software is easier than you might think—and requires zero coding knowledge!

Here’s how you can automate your invoice processing in just four simple steps:

Step 1: Sign up for SmythOS with our simple registration process. All you need is your business email to create your account and get instant access to our platform.

Step 2: Visit the Agent Marketplace from your dashboard and locate the Invoice Processing Assistant. This pre-built solution is ready to use right out of the box!

Step 3: Configure your workflow by connecting your invoice sources. Whether your invoices come via email, shared folders, or direct uploads, our invoice data extraction API handles it all.

Step 4: Launch your solution and watch as your invoices are automatically processed, with key data extracted and organized in seconds.

The best part? You’ll see results immediately. Most users report an 80% reduction in processing time from day one. No more typing data manually, no more errors, and no more lost invoices!

Don’t let another day of invoice paperwork slow down your business. With SmythOS, you can transform your accounts payable process today, without writing a single line of code. Your accounting team will thank you!