How to use:

1. Click Remix

2. Create your account

3. Add required API keys to the Vault

4. Try the agent in debug mode

Stop Manual Financial Statement Analysis – Automate Financial Document Interpretation in Minutes With AI

The Hidden Costs of Manual Financial Analysis

Did you know that financial professionals spend a staggering 75% of their time on manual data processing instead of delivering valuable insights? This hidden time drain is just the tip of the iceberg when it comes to the true cost of traditional financial analysis methods.

Manual financial statement review is like trying to build a house with just a hammer and nails. Sure, it works, but at what cost? The tedious process of inputting numbers from physical documents into spreadsheets creates numerous opportunities for financial errors. Even the most careful analyst can transpose digits or misplace decimal points, potentially leading to million-dollar mistakes in business decisions.

Beyond accuracy concerns, there’s another serious problem: inconsistent analysis. When different team members review financial documents, they often focus on different metrics or apply varying formulas. This creates a patchwork of insights rather than a cohesive financial story – making strategic planning nearly impossible.

Perhaps most concerning is the human toll. Analyst burnout has reached critical levels as talented professionals spend days hunched over spreadsheets instead of applying their expertise to higher-value activities. One survey found that 68% of financial analysts report feeling overwhelmed by repetitive manual tasks.

Meanwhile, decision-makers are forced to rely on outdated insights. By the time manual analysis is complete, the data is often weeks old – practically ancient history in today’s fast-moving markets. In an age where real-time information drives competitive advantage, this lag time represents a significant business liability.

The question isn’t whether manual financial analysis is costing your organization – it’s how much these hidden expenses are impacting your bottom line and competitive position.

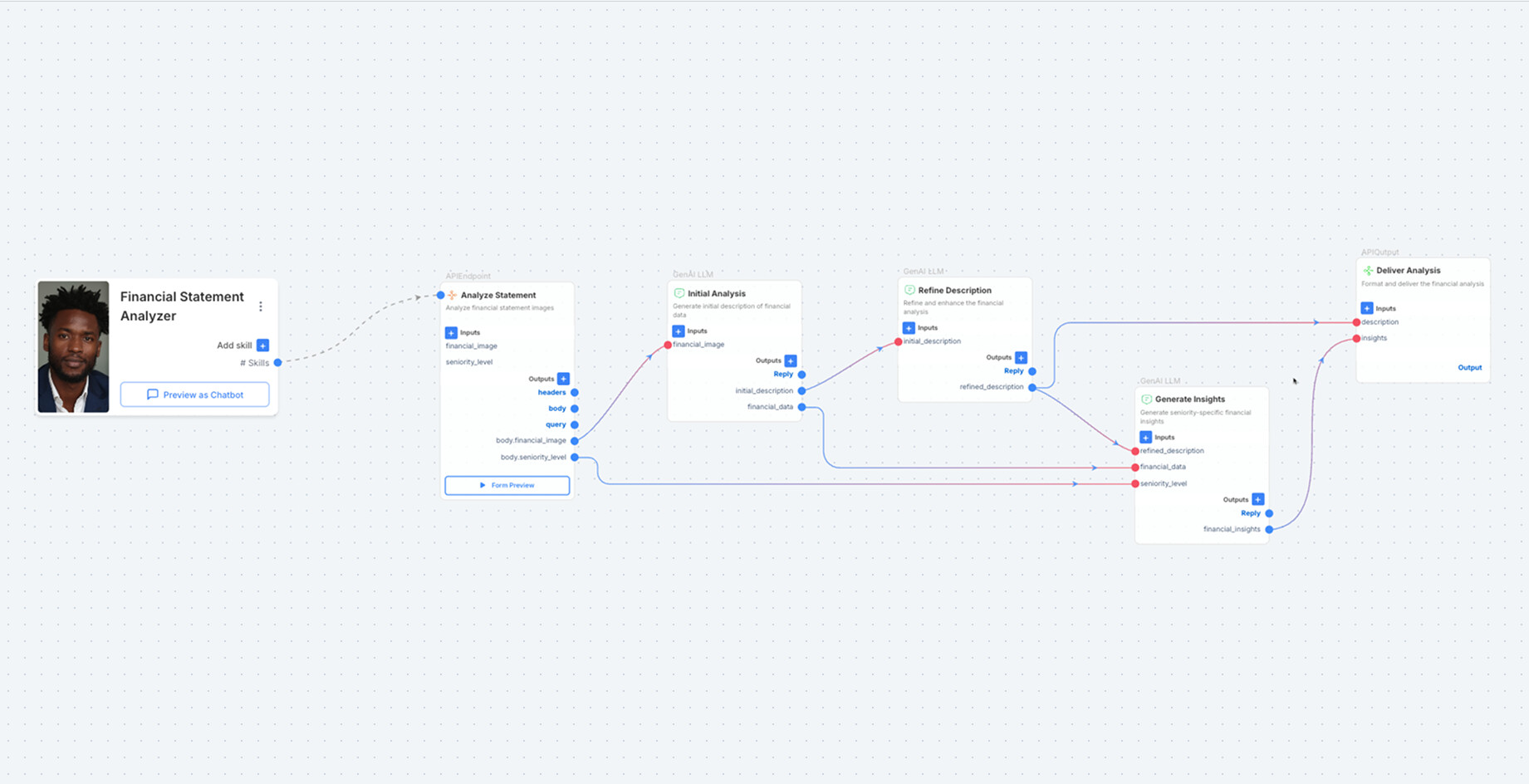

How the Financial Statement Analyzer Works

The Financial Statement Analyzer works through a simple five-step process that turns complicated financial documents into clear, actionable insights. Let’s break down how this smart tool does its magic!

First, the document upload process couldn’t be easier. Just snap a picture of your financial statement or select a PDF from your files. The system accepts various formats, so you don’t need to worry about converting documents beforehand.

Second, our powerful financial statement OCR software gets to work. OCR stands for Optical Character Recognition, which is just a fancy way of saying the system can read all the numbers and text from your document image – even if the print is small or the image isn’t perfect.

Third, the system performs an expertise-tailored analysis of your financial data. This is where SmythOS really shines! Tell the system whether you’re a junior analyst, manager, or CEO, and it adjusts its language and depth of analysis to match your needs. No more drowning in jargon you don’t understand or being frustrated by overly simplified explanations.

Fourth, the insight generation phase kicks in, where the system acts as your personal financial ratio calculator. It automatically computes important numbers like profit margins, debt-to-equity ratios, and return on assets. But instead of just giving you the numbers, it explains what they mean for your business in plain language.

Finally, everything comes together with seamless integration. The Financial Statement Analyzer works perfectly with your existing systems, allowing you to export reports, share insights with your team, or feed the data into other business tools – no complicated IT setup required!

The beauty of this whole process is that what used to take hours of careful analysis can now be completed in just minutes, giving you more time to focus on using those insights rather than just finding them.

Meet Your AI Financial Analyst: The SmythOS Financial Statement Analyzer

Imagine having a financial expert who works 24/7, never takes breaks, and can turn complex financial documents into easy-to-understand insights in just minutes. That’s exactly what the SmythOS Financial Statement Analyzer brings to your desk!

This powerful AI financial analyst transforms those intimidating financial statements into clear, actionable information without you having to crunch a single number. Simply upload a picture of any financial document, tell the analyzer your experience level, and watch as it does all the hard work for you.

Whether you’re just starting out in finance or you’re the CEO making big decisions, the Financial Statement Analyzer adjusts its explanations to match exactly what you need to know. Junior analysts receive detailed breakdowns with educational elements, while executives get straight-to-the-point strategic insights.

The best part? You don’t need to write a single line of code or wait weeks for implementation. With SmythOS, you can deploy this financial statement analyzer software instantly and start receiving customized insights right away. No technical expertise required!

Unlike traditional analysis methods that demand hours of manual review, our AI solution scans entire documents in seconds, identifying important trends, potential problems, and opportunities that human eyes might miss. It’s like upgrading from a calculator to a supercomputer for your financial analysis needs.

Stop drowning in spreadsheets and start making faster, better-informed financial decisions today with your new AI partner in finance.

Why SmythOS Beats Traditional Financial Analysis Methods

Remember spending hours hunched over spreadsheets and financial statements with a calculator in hand? Those days are officially over. SmythOS’s Financial Statement Analyzer revolutionizes how we approach financial analysis, leaving traditional methods in the dust.

When it comes to analysis speed, there’s simply no comparison. What once took financial teams entire workdays to complete now happens in minutes. Upload your document, and the AI immediately gets to work—no coffee breaks needed!

Traditional methods often suffer from human inconsistency. One analyst might focus on different metrics than another, creating confusion. SmythOS delivers consistent insights every time, applying the same rigorous standards to every document it processes.

Perhaps most impressively, the Financial Statement Analyzer offers tailored reporting that traditional methods can’t match. Junior analysts receive explanations that help them learn, while C-suite executives get the high-level strategic insights they need—all from the same document!

Let’s talk about accuracy. Even the most careful human analyst makes mistakes after hours of number-crunching. The SmythOS solution provides mathematical precision that eliminates computational errors and ensures your financial decisions are based on rock-solid data.

While your human team has limits, the Financial Statement Analyzer offers unlimited capacity. Need to process 50 financial statements before tomorrow morning? No problem! The system scales effortlessly without getting tired or making careless mistakes.

Finally, traditional analysis is always backward-looking, often completed days or weeks after documents are received. SmythOS delivers real-time insights, allowing your team to make decisions based on the freshest possible information—a game-changer in today’s fast-moving markets.

Real-World Impact: How One Firm Revolutionized Their Financial Analysis

Horizon Capital, a mid-sized real estate investment firm, was struggling with their financial analysis process. Their team of analysts spent nearly 40 hours each week reviewing potential acquisition targets, limiting how many properties they could evaluate.

After implementing the SmythOS Financial Statement Analyzer, their story changed dramatically. This compelling case study shows exactly how their business transformed:

First, Horizon Capital reduced their analysis time by an impressive 82%. What once took five hours per property now takes just 54 minutes. Their analysts simply upload images of financial statements, and the AI delivers customized insights instantly.

With this time savings, the firm quadrupled their evaluation capacity. Instead of assessing 8 properties weekly, they now evaluate 32 potential investments in the same timeframe, giving them a serious competitive advantage in their market.

“The decision consistency we’ve achieved is remarkable,” explains Sarah Chen, Horizon’s Chief Investment Officer. “Before, different analysts might reach different conclusions about the same property. Now, everyone works from the same AI-powered analysis, adjusted for their expertise level. This has eliminated costly disagreements and streamlined our investment meetings.”

The most impressive result? Horizon’s acquisition performance has improved by 26% in just six months. By examining more properties and making better-informed decisions, they’re finding better deals with higher returns.

The real estate investment landscape is competitive, but Horizon Capital has positioned themselves ahead of rivals who still rely on spreadsheets and manual calculations. Their success story demonstrates how embracing AI tools doesn’t just save time—it fundamentally transforms business outcomes.

Transform Your Financial Analysis Today

The financial industry waits for no one. While you’re still manually crunching numbers, your competitors are already leveraging AI to gain a competitive advantage that grows every day. Can you afford to fall behind?

The good news? Getting started couldn’t be easier. Our quick start process means you can build financial analyzer capabilities into your workflow today—not next quarter or next year. Simply upload your first financial document and watch as SmythOS transforms hours of analysis into minutes of actionable intelligence.

This isn’t just about keeping pace—it’s about preparing for tomorrow. Financial regulations change. Reporting standards evolve. Markets shift. Only a future-proof analysis solution adapts in real-time, ensuring you’re never caught off-guard by changing requirements or emerging trends.

The strategic value extends beyond time savings. Imagine every financial decision backed by deeper insights. Every meeting prepared with comprehensive analysis. Every opportunity identified before your competitors even see it coming.

Don’t let another day pass with outdated analysis methods. Your financial future starts now. Transform your approach today and discover what truly informed financial decision-making feels like.