How to use:

1. Click Remix

2. Create your account

3. Add required API keys to the Vault

4. Try the agent in debug mode

Stop International Tax Confusion – Automate Business Expense Analysis in Minutes With AI

The Hidden Cost of Manual Business Expense Qualification

Did you know that financial professionals spend an average of 12+ hours every week manually reviewing, researching, and qualifying business expenses? That’s over 600 hours annually – time that could be spent on growing your practice or providing higher-value services to clients.

Manual expense qualification isn’t just time-consuming – it’s mentally draining. Every receipt, every transaction, every expense report requires careful consideration against constantly changing tax rules. This leads to something experts call ‘decision fatigue’ – where your brain simply gets tired of making complex choices, increasing the risk of errors and missed deductions.

The challenge multiplies dramatically when dealing with expenses across different countries. What’s fully deductible in one jurisdiction might be partially allowed in another and completely disallowed in a third. Keeping track of these differences manually is nearly impossible without investing countless hours in research or risking compliance failures.

Many accounting professionals share the same frustration: “I spent three hours researching whether a client’s mixed-use property expenses qualified under both US and UK tax codes, only to realize I needed to double-check everything because of recent regulatory changes.”

Beyond the immediate time waste, manual expense qualification creates opportunity costs that aren’t immediately visible on your balance sheet. While you’re buried in receipts and tax codes, your competitors are developing stronger client relationships and expanding their service offerings.

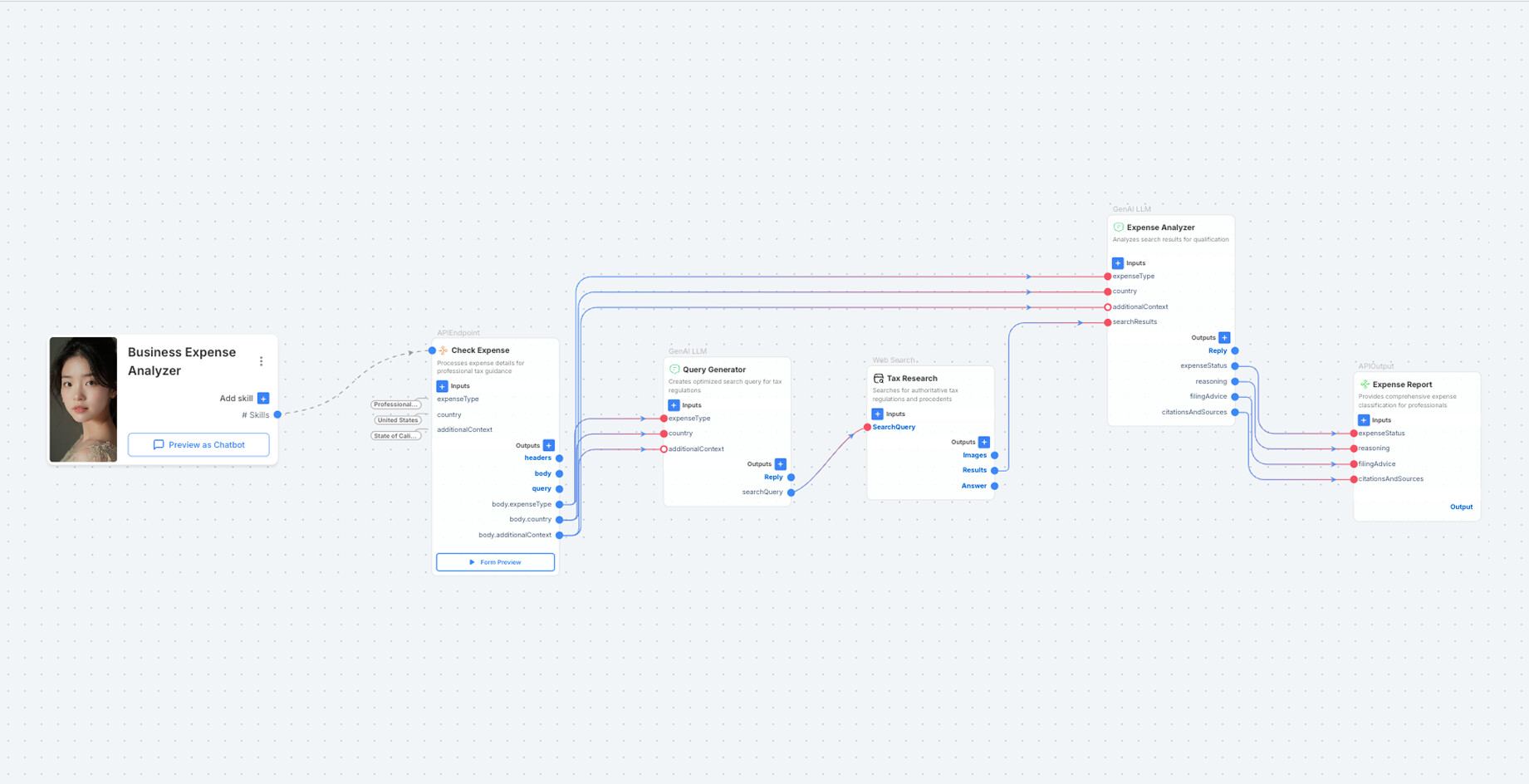

How the Business Expense Analyzer Works

The SmythOS Business Expense Analyzer transforms complicated tax work into a simple, streamlined process. Let’s look at how this smart AI tool handles your business expenses from start to finish:

1. Intake and Categorization – When you upload your expenses, the system automatically sorts them into the right categories. No more manual sorting through receipts and invoices! The expense categorization engine recognizes common business costs like travel, meals, office supplies, and equipment purchases, organizing everything neatly for review.

2. Multi-Country Regulatory Analysis – This is where the magic happens. The analyzer checks your expenses against tax rules for different countries simultaneously. For example, a business lunch might be 50% deductible in one country but 100% deductible in another. The regulatory analysis engine keeps track of all these differences so you don’t have to memorize complex international tax codes.

3. Detailed Qualification Assessment – For each expense, the system provides a clear yes/no answer on business expense eligibility. But it doesn’t stop there – it explains WHY an expense qualifies (or doesn’t). The qualification assessment includes supporting reasons drawn from the most current tax regulations, giving you complete confidence in every determination.

4. Actionable Filing Guidance – Finally, you receive specific instructions for how to properly record and file each expense. The filing guidance tells you exactly which forms to use, what documentation to keep, and any special requirements for different countries. This practical advice turns complex tax knowledge into clear next steps.

The entire process takes minutes instead of hours, and because it’s powered by SmythOS’s advanced AI, the system continues learning and improving with each use. You’ll always have access to the latest tax insights without needing to constantly research changing regulations yourself.

The Solution: AI-Powered Business Expense Analyzer

Say goodbye to tax headaches! The SmythOS Business Expense Analyzer transforms what used to take hours into just seconds of smart, automated analysis. This powerful AI solution works tirelessly around the clock, checking your business expenses against tax rules from multiple countries at once.

The beauty of this AI-powered expense analyzer is that it requires zero coding knowledge. Whether you’re a seasoned accountant or just starting your financial practice, you can set up and use this tool right away. It’s like having a tax expert who never sleeps, never gets tired, and never makes careless mistakes.

With SmythOS’s expense qualification automation, you’ll no longer need to flip through endless tax guidebooks or worry about missing important deductions. The system automatically evaluates each expense, provides clear reasoning for its decisions, and offers specific filing advice tailored to each country’s requirements.

Financial professionals using the SmythOS Business Expense Analyzer report saving 15-20 hours weekly on research time alone. This tax decision automation tool doesn’t just save time—it helps you deliver more value to clients by identifying legitimate deductions they might otherwise miss.

Best of all, as tax laws change (and they frequently do!), the AI stays up-to-date, ensuring your expense classifications remain compliant across all jurisdictions where your clients do business.

Why SmythOS Business Expense Analyzer Outperforms Traditional Methods

When it comes to handling business expenses, the old way of doing things just doesn’t stack up against SmythOS’s powerful AI solution. Let’s see how they compare side by side:

Time Savings: Traditional methods require hours of manual research flipping through tax guidebooks and regulations. The SmythOS Business Expense Analyzer delivers answers in seconds, freeing up your day for higher-value work with clients.

Consistency in Analysis: Humans get tired, distracted, or might interpret rules differently from day to day. Our AI tool applies the same thorough analysis every single time, eliminating human error and ensuring reliable results for every expense you evaluate.

Multi-Jurisdiction Analysis: Handling expenses across different countries traditionally means consulting multiple experts or resources. The SmythOS analyzer seamlessly evaluates expenses according to tax rules in multiple countries at once, making international business a breeze.

Instant Assessment: With traditional methods, clients might wait days for answers about their expense questions. Our AI provides immediate feedback, letting you respond to client queries during the same meeting or call, impressing them with your efficiency.

Up-to-Date Regulations: Tax rules change constantly, and keeping physical references current is nearly impossible. The SmythOS analyzer stays updated with the latest regulations across all jurisdictions, ensuring your compliance advice is never outdated.

Standardized Documentation: Manual processes often result in inconsistent record-keeping. Our AI solution creates uniform, clear documentation for every expense analysis, creating an audit trail that both you and your clients can trust.

By switching from traditional methods to the SmythOS Business Expense Analyzer, financial professionals can transform their practice from constantly playing catch-up to confidently staying ahead of compliance requirements while delivering exceptional value to clients.

Real-World Success: From Overwhelmed to Optimized

Meet Global Tax Partners, a mid-sized accounting firm that was drowning in international expense verification work. Before discovering the SmythOS Business Expense Analyzer, their team spent an average of 12 hours per client sorting through tax-deductible expenses across multiple countries.

“We were constantly worried about missing important deductions or making compliance mistakes,” explains Maria Chen, the firm’s managing partner. “Our staff was overwhelmed, and we had to turn away new business.”

Within just three months of implementing the Business Expense Analyzer, their success story took a dramatic turn. The firm achieved an impressive 82% reduction in research time, with expense verification now taking just 2.1 hours per client on average.

“The time reduction alone was worth the investment,” says Chen. “But we’ve seen so many other benefits too.” The firm reported a 14% improvement in deduction rates for their clients, identifying legitimate tax write-offs that would have been missed under their manual process.

Client satisfaction scores soared as well. “Our clients love that we can now explain exactly why each expense qualifies or doesn’t qualify in different countries. The detailed reasoning gives them confidence in our expertise,” Chen notes.

Perhaps most impressive is how Global Tax Partners achieved 22% client growth without adding a single new staff member. The increased efficiency allowed their existing team to take on more clients while actually delivering better service.

“Before the Business Expense Analyzer, international tax work was our biggest headache,” Chen concludes. “Now it’s become our competitive advantage. We actively seek multinational clients because we know we can handle their expense verification needs better than anyone else.”

Quick Start Guide: Launch Your Own Business Expense Analyzer

Ready to transform your financial practice with the power of AI? Getting started with your own Business Expense Analyzer is surprisingly simple. In fact, you can be up and running in less than 30 minutes by following these four easy implementation steps:

1. Sign up for SmythOS and access the Business Expense Analyzer template from our library of AI solutions.

2. Customize the analyzer to match your specific service needs – select which countries you want tax coverage for and adjust the interface to match your brand.

3. Connect your existing client data systems or set up simple input forms for new expense information.

4. Test the analyzer with sample expenses to ensure everything works perfectly before rolling it out to clients.

What makes this quick start guide so powerful is that you don’t need any coding skills or technical expertise. The automated tax services are ready to work right out of the box, with all the expense analysis capabilities built in.

As your practice grows, you can easily scale your service offering. Start with basic expense qualification and gradually expand to comprehensive tax planning, audit preparation, or specialized industry solutions. Many of our users begin with a single country focus and later add international capabilities as their client base diversifies.

The Business Expense Analyzer isn’t just a tool – it’s the foundation for building more valuable, efficient financial services that set you apart from competitors still stuck in manual processes. Why spend another day drowning in tax regulations when you could be delivering superior results to happy clients?

Take the first step today and discover how automated expense analysis can revolutionize your financial practice – in minutes, not months.