Imagine this: You’ve spent a lifetime building your assets, caring for your loved ones, and planning for the future. Now, all of that hard work could go to waste because of one simple oversight. Nearly 70% of Americans lack even the most basic estate planning document—a will. Are you one of them?

Estate planning documents are essential for financial preparedness. They’re not just for the wealthy or the elderly; they’re crucial tools for anyone who wants to protect their assets and ensure their wishes are respected, even when they can no longer speak for themselves.

What exactly are these documents, and why should you care? Let’s explore the world of estate planning to understand why these legal instruments are vital for your peace of mind and your family’s future.

The Building Blocks of Estate Planning

An estate plan is a collection of legal documents that act as your financial and medical voice when you can’t speak for yourself. These documents include wills, trusts, powers of attorney, and beneficiary designations. Each plays a unique role in managing your assets and ensuring your wishes are followed, whether you’re incapacitated or have passed away.

Think of your estate plan as a roadmap for your loved ones. Without it, they’re left to navigate a complex legal landscape during an already emotional time. According to estate planning experts, these documents are crucial for avoiding probate, minimizing taxes, and protecting your beneficiaries.

Estate planning documents also cover critical healthcare decisions. Imagine being unable to communicate your medical preferences—who would speak for you? That’s where advance directives and healthcare powers of attorney come into play, ensuring your healthcare wishes are respected even when you can’t express them yourself.

Why You Can’t Afford to Procrastinate

“I’m too young to worry about estate planning,” you might think. Or perhaps, “I don’t have enough assets to bother with all this paperwork.” These are common misconceptions that leave countless families vulnerable to legal and financial headaches.

Life is unpredictable. Accidents and illnesses don’t discriminate based on age or wealth. By creating an estate plan now, you’re not being morbid—you’re being responsible and showing love for your family by sparing them difficult decisions and potential conflicts down the road.

Moreover, estate planning isn’t just about what happens after you die. Powers of attorney and healthcare directives are invaluable if you become incapacitated. They ensure your financial affairs continue smoothly and your medical care aligns with your wishes, even if you can’t manage them yourself.

In essence, estate planning documents are your legacy in action. They’re how you continue to care for your loved ones and protect what you’ve built, even when you can no longer do so personally. Isn’t it time you took control of your legacy?

As we explore the specifics of wills, trusts, and powers of attorney, remember: estate planning is an act of love. It’s about providing clarity, reducing burden, and ensuring your voice is heard when it matters most. Don’t let procrastination rob you and your loved ones of this invaluable gift.

What are the Essential Estate Planning Documents Everyone Needs?

Estate planning is crucial for anyone who wants to protect their assets and loved ones. Here are the key documents you need for a comprehensive estate plan.

The cornerstone of any estate plan is the will. This document outlines your wishes for asset distribution and designates guardians for minor children. Without it, these critical decisions are left to the courts.

A trust is a powerful tool for managing property both during your lifetime and after you’re gone. Trusts offer more control and can help avoid the time-consuming and potentially costly probate process.

Healthcare and Financial Decision-Making Documents

For medical decisions, two documents are essential. A healthcare power of attorney appoints someone to make medical decisions on your behalf if you’re incapacitated. This works hand-in-hand with a living will or advanced directive, which outlines your preferences for end-of-life care.

On the financial side, a financial power of attorney is crucial. This document allows a trusted individual to manage your finances if you’re unable to do so yourself, ensuring bills are paid and your financial affairs remain in order.

Don’t overlook beneficiary designations for accounts that pass outside of a will, such as life insurance policies and retirement accounts. These designations typically supersede instructions in your will, so keeping them up-to-date is vital.

Additional Documents to Consider

A letter of intent, while not legally binding, can provide valuable clarity on your wishes. It explains the reasoning behind your decisions or provides guidance on matters not covered in your will.

For those with minor children, guardianship designations are crucial. While often included in a will, some choose to create separate documents to ensure there’s no ambiguity about their intentions.

The peace of mind these documents provide is invaluable. Consider working with an experienced estate planning attorney to ensure your documents are properly prepared and legally sound.

By putting these essential documents in place, you’re providing a roadmap for your loved ones during a difficult time. It’s one of the most thoughtful gifts you can leave behind.

Where Can I Find Resources and Templates for These Documents?

Estate planning can seem daunting, but numerous free online resources simplify the process. DoYourOwnWill.com offers a variety of no-cost estate planning documents, including wills, living wills, and power of attorney forms. These tools help you organize crucial information without breaking the bank.

The “BASIC ESTATE PLANNING TEMPLATE” serves as an excellent starting point. This comprehensive form guides you through collecting essential details about your personal life, family members, and financial assets. By methodically filling out each section, you create a clear snapshot of your estate.

| Platform | Features | Pricing | Pros | Cons |

|---|---|---|---|---|

| LegalZoom | Hybrid services, attorney support | Starts at $99 | Convenient, user-friendly | Additional costs, not ideal for complex estates |

| Trust & Will | Easy and affordable will creation | Transparent pricing | User-friendly, excellent customer support | Extra charges for attorney consultations |

| Rocket Lawyer | Legal assistance via phone, email, chat | Flexible pricing | Comprehensive services, positive customer support | Membership cost, limited free document updates |

| Nolo’s Quicken WillMaker | Range of documents, easy intake | Starter: $99, Plus: $139, All Access: $209 | Comprehensive, cost-effective | Complex navigation, regional limitations |

| BlueNotary | Free templates, compliance with state laws | Free | Secure, easy-to-use, supports document updates | Not suitable for complex estates |

Online platforms provide more than just document templates. They often include educational resources to help you understand complex legal terms and make informed decisions. Some sites even offer interactive questionnaires that generate customized documents based on your responses.

While DIY estate planning can be cost-effective, it’s crucial to ensure your documents comply with state laws. Many online resources update their templates regularly to reflect current legal requirements, but it’s wise to double-check or consult a professional for complex situations.

Remember, estate planning isn’t a one-and-done task. Life changes, and so should your plans. Regularly review and update your documents to reflect new assets, family dynamics, or personal wishes. Some online platforms allow you to make these updates easily, ensuring your estate plan remains current.

Securely Managing Your Estate Planning Information

Once you’ve gathered all your estate planning information, proper storage becomes paramount. Keeping these documents safe yet accessible can be a delicate balance. Physical copies in a fireproof safe at home offer immediate access, while digital storage provides flexibility and easy updates.

Consider using a secure digital platform like SmythOS to manage your estate planning documents. Such platforms offer bank-level encryption to protect your sensitive information while allowing you to update and access your documents from anywhere. This approach ensures your plans remain current and readily available when needed.

SmythOS and similar tools often include features like document sharing, allowing you to grant secure access to trusted family members or your attorney. This capability can prove invaluable during emergencies or when executing your estate plan.

While online resources and digital management tools streamline the estate planning process, remember that complex estates or unusual circumstances might require professional legal advice. These DIY tools serve as an excellent starting point, but don’t hesitate to seek expert guidance when necessary.

By leveraging free online resources and secure digital management tools, you can create a comprehensive, up-to-date estate plan without significant expense. This proactive approach offers peace of mind, knowing you’ve taken important steps to protect your assets and provide for your loved ones.

What Specific Details Should These Estate Planning Documents Include?

Estate planning documents ensure your wishes are honored and your loved ones are cared for after you’re gone. To create a comprehensive estate plan, gather specific personal information for yourself, your spouse, and your children. Here are the essential details these documents typically require.

Provide basic identification information, including full legal names, dates of birth, and social security numbers for everyone involved in your estate plan. These details are crucial for accurately identifying beneficiaries and ensuring your assets are distributed correctly.

Current contact information is vital. Your estate planning documents should include up-to-date addresses, phone numbers, and email addresses for you, your spouse, and your children. This information helps executors and trustees communicate with beneficiaries efficiently.

Essential Information for Estate Planning Documents

To simplify gathering necessary information, consider creating a comprehensive checklist. This list should include:

- Full legal names (including maiden names if applicable)

- Dates and places of birth

- Social security numbers

- Current residential addresses

- Phone numbers (home, work, and mobile)

- Email addresses

Your estate planning documents may also require information about your assets and liabilities, including real estate properties, bank accounts, investment portfolios, retirement accounts, and any outstanding debts or loans.

For parents with minor children, include information about potential guardians. This should encompass the full names, addresses, and contact details of your chosen guardians, as well as any alternate guardians you’ve designated.

Managing and securing this sensitive information can be challenging. Digital platforms like SmythOS offer a secure, centralized system for storing and organizing your essential estate planning details.

By using a digital platform, you ensure that your information is protected and easily accessible when needed. This approach streamlines the estate planning process and provides peace of mind, knowing your crucial data is securely managed and readily available for updates or revisions.

Gathering and organizing specific personal details is a critical step in creating effective estate planning documents. By maintaining a comprehensive checklist and leveraging secure digital platforms, you can simplify the process and ensure your estate plan accurately reflects your wishes and provides for your loved ones.

How Can I Ensure My Estate Plan Stays Up-to-Date and Effective?

Maintaining an up-to-date estate plan is crucial for protecting your assets and ensuring your wishes are carried out. Life’s constant changes demand regular attention to this important document. Here are some key strategies to keep your estate plan current and effective.

Regular Reviews: Your Estate Plan’s Lifeline

Mark your calendar: experts recommend reviewing your estate plan every three to five years. This isn’t just busywork—it’s a vital check-up for one of your most important legal documents.

Don’t wait for that arbitrary date if life throws you a curveball. Major life events should trigger an immediate review. Got married? Had a child? Divorced? These milestones can significantly impact how you want your assets distributed.

Even seemingly minor changes, like moving to a new state, can affect the legal validity of your documents. Stay proactive to avoid potential headaches for your loved ones down the road.

Beneficiary Designations: The Often Overlooked Detail

Here’s a common pitfall: forgetting to update beneficiary designations on accounts like life insurance policies or retirement plans. These designations often trump what’s written in your will, so keeping them current is critical.

Did you know that failing to update beneficiaries after a divorce could result in an ex-spouse inheriting your retirement savings? Don’t let an oversight derail your intentions.

Embracing Technology for Effortless Maintenance

Gone are the days of dusty filing cabinets and easily misplaced documents. Enter the digital age of estate planning. Platforms like SmythOS offer a centralized hub for all your estate planning documents, making updates a breeze.

Imagine automated reminders nudging you when it’s time for a review. Or instant access to your documents from anywhere, anytime. This level of organization can be a game-changer in keeping your plan current.

The Power of Professional Guidance

While DIY estate planning tools are increasingly popular, there’s no substitute for professional legal advice. An experienced estate planning attorney can spot potential issues you might miss and ensure your plan aligns with current laws.

Consider scheduling a quick check-in with your attorney every few years. They can help you navigate complex changes in tax laws or estate regulations that might impact your plan.

Actionable Tips for Keeping Your Estate Plan Current

Ready to take charge of your estate plan maintenance? Here are some concrete steps you can take:

- Create a ‘life changes’ checklist. Include events like births, deaths, marriages, divorces, and significant financial changes.

- Set annual reminders to review beneficiary designations on all accounts.

- Maintain an updated inventory of assets, including digital assets like cryptocurrency or online accounts.

- Consider using an estate planning workbook to organize your information and track changes over time.

- Communicate with your executor or trustee. Ensure they know where to find your documents and understand your wishes.

Remember, an outdated estate plan can be almost as problematic as having no plan at all. By staying vigilant and embracing tools that simplify the process, you’re not just maintaining a document—you’re safeguarding your legacy and providing peace of mind for your loved ones.

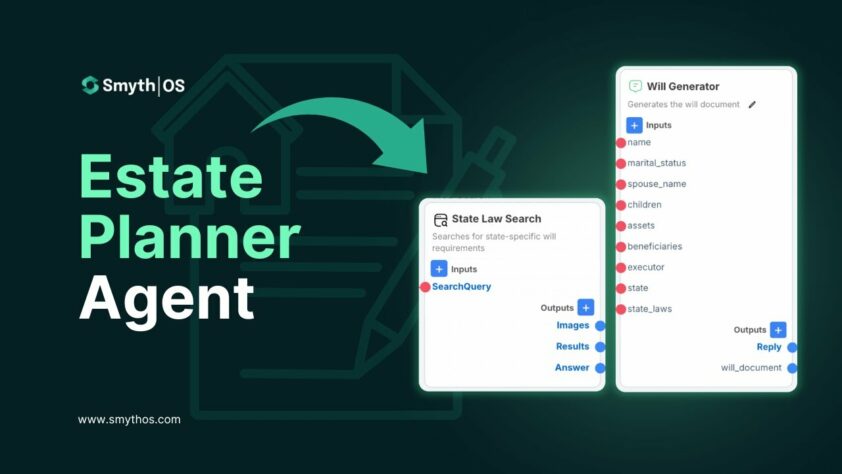

Using SmythOS to Build an AI Agent for Estate Planning Documents

Estate planning doesn’t have to be overwhelming or expensive. With SmythOS, you can create a custom AI agent that simplifies the process and helps you generate personalized estate planning documents with ease.

Imagine an intelligent assistant that walks you through every step of creating your will, trust, power of attorney, or healthcare directive—no legal jargon, no confusion. SmythOS allows you to build an agent that asks the right questions, captures your responses, and compiles accurate, legally-informed drafts tailored to your needs and state requirements.

Need to update your beneficiary designations or revise your healthcare preferences? Your SmythOS agent can help you make adjustments as your life evolves—whether that’s due to marriage, having children, moving states, or a change in financial circumstances. Everything is stored securely and can be updated anytime from your dashboard.

For families, estate attorneys, and financial advisors alike, building a document automation agent with SmythOS streamlines repetitive legal work, reduces costs, and gives peace of mind to users who want to protect their legacy with clarity and confidence.

Ready to take control of your future? Build your estate planning assistant with SmythOS today and turn your intentions into action—efficiently, securely, and intelligently.

Conclusion: Securing Your Legacy Through Comprehensive Estate Planning

Creating a comprehensive estate plan is a crucial step for anyone who wants to secure their legacy and protect their loved ones. By understanding and implementing key estate planning documents, you’re making a profound investment in your family’s future.

An effective estate plan goes beyond drafting a will. It includes tools such as trusts, powers of attorney, and healthcare directives, each playing a vital role in ensuring your wishes are honored and your family is cared for. These documents provide a safety net for your loved ones, potentially saving them from unnecessary stress, conflict, and financial burden during difficult times.

Regularly reviewing and updating your estate plan is equally important. As life changes, so should your plan. Marriages, divorces, births, and significant financial shifts all warrant a fresh look at your estate planning strategy. This ongoing process helps maintain the relevance and effectiveness of your plan, adapting it to your evolving circumstances and desires.

Platforms like SmythOS offer innovative solutions to streamline the estate planning process. These tools help you organize, manage, and secure your important information, simplifying the complex world of estate planning to ensure your legacy is preserved as you intend.